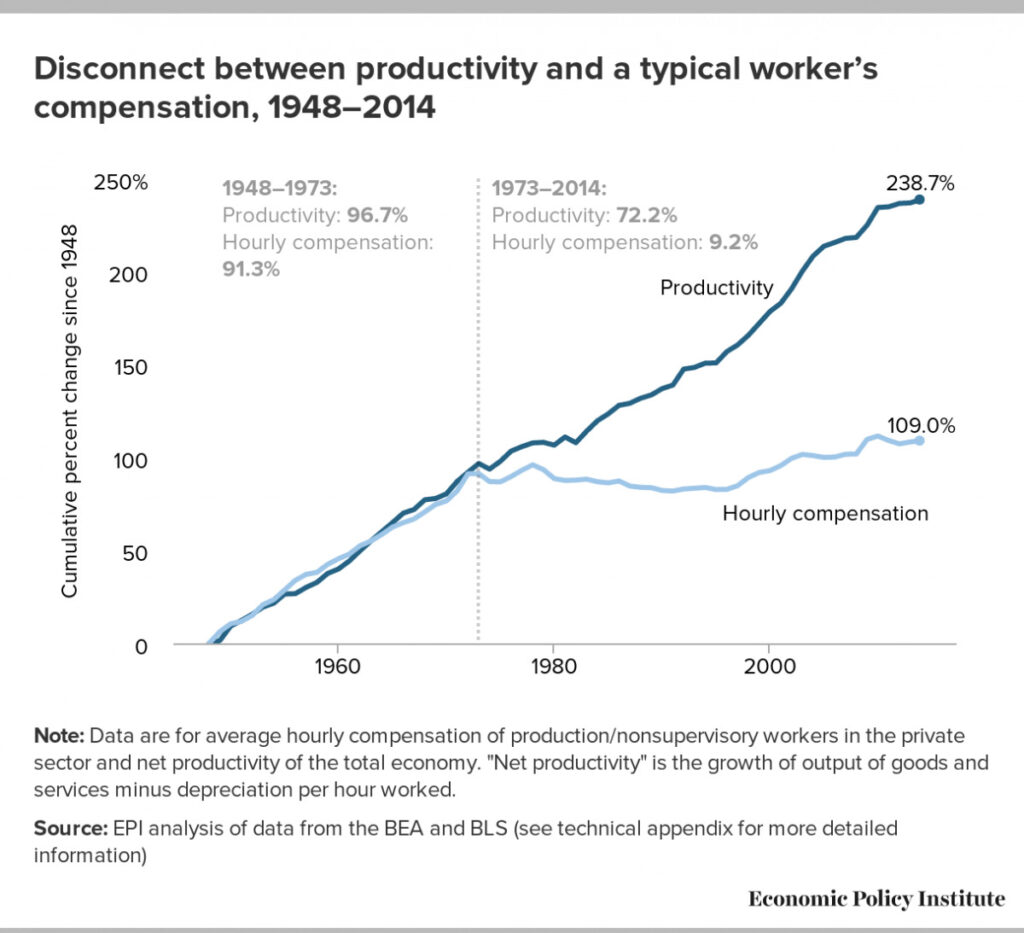

Did you know 50 TRILLION DOLLARS was gutted from the bottom 90% by the top 10% in the last 40 years? Maybe it made a splash when the paper describing the theft was first published in 2020, but I hadn’t heard about it till now because everyone’s been distracted by drag shows, Antifa, and sexy M&Ms. But the number is real, and far from a blip in economic data it may be an actual, fundamental reason for real problems like medical, school, and consumer debt, homelessness, and our crumbling Middle Class.

No one knew precisely how much money has been plundered by the upper 10% until the Rand Corporation’s 2020 “Trends in Income From 1975 to 2018” pegged it at $50 trillion dollars. Fifty crippling capital-T TRILLION dollars is how much the upward ‘redistribution of wealth’ has cost American workers since 1975. If we’d stuck with the balance since World War II (1945 through 1974), the annual income of Americans earning below the 90th percentile would have been $2.5 trillion higher in just 2018 alone, enough for every worker in the bottom 90% of our economy to earn $1,144 a month more than they’re getting now. Every month. Every single year. Just a couple paragraphs from the TIME article on the report…

No one knew precisely how much money has been plundered by the upper 10% until the Rand Corporation’s 2020 “Trends in Income From 1975 to 2018” pegged it at $50 trillion dollars. Fifty crippling capital-T TRILLION dollars is how much the upward ‘redistribution of wealth’ has cost American workers since 1975. If we’d stuck with the balance since World War II (1945 through 1974), the annual income of Americans earning below the 90th percentile would have been $2.5 trillion higher in just 2018 alone, enough for every worker in the bottom 90% of our economy to earn $1,144 a month more than they’re getting now. Every month. Every single year. Just a couple paragraphs from the TIME article on the report…

“…the RAND report brings the inequality price tag directly home by denominating it in dollars—not just the aggregate $50 trillion figure, but in granular demographic detail. For example, are you a typical Black man earning $35,000 a year? You are being paid at least $26,000 a year less than you would have had income distributions held constant. Are you a college-educated, prime-aged, full-time worker earning $72,000? Depending on the inflation index used (PCE or CPI, respectively), rising inequality is costing you between $48,000 and $63,000 a year. But whatever your race, gender, educational attainment, urbanicity, or income, the data show, if you earn below the 90th percentile, the relentlessly upward redistribution of income since 1975 is coming out of your pocket.”

“The iron rule of market economies is that we all do better when we all do better: when workers have more money, businesses have more customers, and hire more workers. Seventy percent of our economy is dependent on consumer spending; the faster and broader real incomes grow, the stronger the demand for the products and services American businesses produce. This is the virtuous cycle through which workers and businesses prospered together in the decades immediately following World War II. But as wages stagnated after 1975, so too did consumer demand; and as demand slowed, so did the economy. A 2014 report from the OECD estimated that rising income inequality knocked as much 9 points off U.S. GDP growth over the previous two decades—a deficit that has surely grown over the past six years as inequality continued to climb. That’s about $2 trillion worth of GDP that’s being frittered away, year after year, through policy choices that intentionally constrain the earning power of American workers.”

Market efficiency has limits; at some point there just aren’t enough resources to do the job. Government created to ‘promote the general welfare’ has been bought, corrupted, and declared the enemy. We see the failure in massive homeless camps, failed education systems, crumbling medical care, inadequate retirement, unresponsive police, and more. Democrats’ timid attempts to fix things are fought at every turn, and instead we’re offered reality-defying platitudes, fascist authoritarianism, and the hatred of the different among us as a ‘solution’. Nothing goes to fix the strangulation of resources, but everything goes to propagandize the shrinking line between a teetering Middle Class and the desperate failures on the other side of it. And to by God keep ‘em there.

The “pie” has grown but 90% of us haven’t tasted it because an economy is the flow of money, not the amount of money, and for 40 years the flow of our money has been strangled. Our societal failures aren’t the result of some Stalinist left and they’re barely the fault of the MAGA right (which seems more symptom than cause). No, I think maybe, just maybe, the relentless daily pressure to survive when there’s just not enough gets to all of us. Our failing society is the fault of the greedy, and the failure of government to represent 90% of us instead of just 10%.

Make a great day,

Digging Deeper…

The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That’s Made the U.S. Less Secure, Hanauer and Rolf in TIME, Sep 2020

Trends in Income From 1975 to 2018, Price and Edwards at the Rand Corporation, 2020

What Is Middle Class Income? The Latest Numbers Available, Jake Frankenfield in Investopedia, Jul 2022

States are flush with cash. It’s setting off “tax cut fever.”, Aimee Picchi on CBS News, Feb 2023

The Far-Right’s Culture Wars Are Just a Distraction So Oligarchs Can Keep Looting the Working Class, Thom Hartmann on Common Dreams, Mar 2023

The Politics of Moral Panics, Allouche et al at the Century Foundation, May 2022

Seven reasons to worry about the American middle class, Krause and Sawhill at Brookings Institute, Jun 2018

Where Did Your $50 trillion Go? (Video) Thom Hartmann and Richard Wolff, Jan 2021

Dear Republicans: We Tried Your Way and It Does Not Work, Thom Hartmann on The Hartmann Report, May 2022

College tuition ‘astronomically’ increased since U.S. Supreme Court justices were students, Maya Boddie on AlterNet, Mar 2023

Half in U.S. Say They Are Worse Off, Highest Since 2009, Jeffrey Jones at Gallup, Feb 2023

Do wealthy Americans have too much power? Hanauer and Hartmann on Pitchfork Economics, Feb 2021

“This was preventable”: Railroad workers explain how Wall St caused the East Palestine derailment, Maximillian Alvarez on The Real News, Feb 2023

Graphs with Reagan election, Ward Q. Normal on Twitter, Dec 2019