Greetings,

When anyone dares suggest the ultra-rich should pay a ‘fair share’, a pseudo-intellectual will pop up to stop such dangerous thinking by shouting “Oh yeah? What’s a fair share?” The not-so-subtle implication is since there’s no objective and specific way to define ‘fair’, who’s to say if a 0% or 100% tax is fair? It’s all the same, so checkmate, Libs! The conversation rarely moves much farther, but what if it did? What if there was an answer to ‘what’s a fair share’?

A government that collects less than it spends or more than the people can afford becomes unstable, so a ‘fair share’ for the whole society must be very close to total government spending. The shareholders, (ie: taxpayers) are only either individuals or businesses, which coincidentally hold all the wealth in the country. A ‘fair’ system would divide the load proportionally to their shares of overall wealth.

These individuals and businesses are not monoliths. Each has critical differences between members so while “tax everyone at the same rate” sounds fair, it isn’t. High taxes threaten survival for the poor, while low taxes on the rich allow wealth and power to concentrate and corrupt the whole system. It would be silly to tax Jeff Bezos like a homeless person or a sole-prop startup like a multinational corporation, so a ‘fair’ system would adapt to these differences.

Put all that together and we have an answer…

- All the ‘fair shares’ add up to total government spending.

- A ‘fair share’ for any taxpayer starts low (never 0%) and increases with the taxpayers’ wealth (never 100%).

- A ‘fair share’ is NOT so big that it threatens growth of an individual or business, and NOT so small that it allows toxic wealth.

- YOUR specific ‘fair share’ will almost certainly be different from the person down the street and will change over your lifetime.

This doesn’t put a number to a ‘fair share’, but it is an objective yardstick to tell if someone is carrying their part of the load. The overall tax system is unfair if it’s largely above or below total spending, and tax cuts are unfair when they let any sector avoid their responsibilities. Unfair taxes don’t leave the poorest enough money to live. Unfair taxes let multi-billion-dollar companies or rich individuals pay nothing.

If a range isn’t very satisfying there’s a way to get precise, and it’s a foundation of our government. When there’s no provably ‘right’ answer (which is almost always the case), we send representatives to government to settle on one acceptable answer while avoiding the unacceptable ones. Ideologies can drive the representatives into different philosophical corners, but the ‘fair share’ yardstick shows when ideology has trumped good government. None of our representatives seem to like it, but transparency in the process is there for anyone reading the news and accountability comes with our vote.

Every society has some type of government to fund. Despotisms, thugocracies, and monarchies extract blood and treasure as they choose, so ‘fairness’ doesn’t matter. In the US, the common understanding of We The People is that government exists through our power, obligations run both ways, and some equitable funding method exists (whether we’re using it or not). That pseudo-intellectual is right; there’s no provably right answer to what a ‘fair share’ is, but that’s not a roadblock… there are provably wrong ones. It’s up to us to know the difference, and hold our representatives accountable when they ignore it.

Make a great day,

Digging Deeper…

Here’s a look at some of the details of the US tax system from “EXPLAINER-The $4 trillion U.S. government relies on individual taxpayers” on Devdiscourse

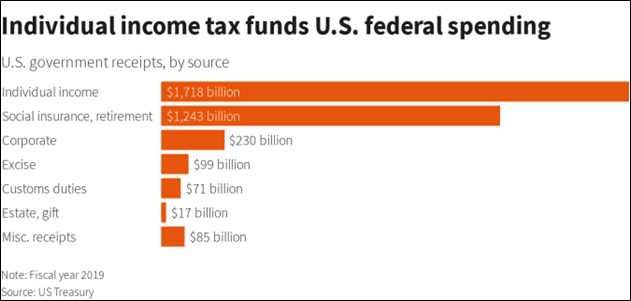

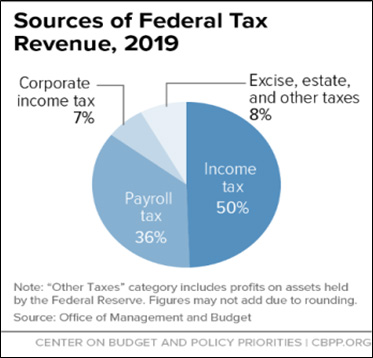

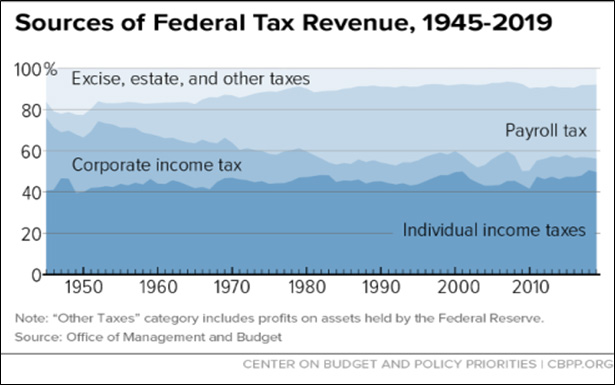

“Individuals, whether they are self-employed or earn a paycheck from a small business or a giant corporation, foot most of the federal government’s bills.,, Of the $3.46 trillion in receipts taken in by the U.S. Treasury during fiscal 2019, nearly half came from the $1.72 trillion in individual income taxes collected.

In addition, $1.24 trillion in Social Security and Medicare taxes were paid by individuals, bringing their share to 85%.

Taxes paid by corporations last year totaled $230 billion, or just 6.6% of the total in 2019. The remainder of federal revenues are made up from customs duties on imported goods, excise taxes such as those on gasoline, estate taxes and other miscellaneous taxes and fees…

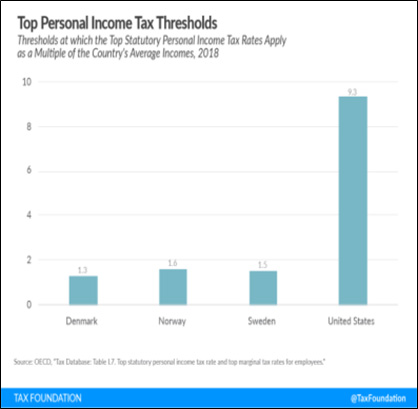

The very poorest, those making under $9,875 a year, are taxed at a 10% rate, while the wealthiest, or those making $518,400 and over are taxed at a 37% rate. But what the wealthiest pay is often much lower due to a variety of complicated tax loopholes, which can benefit hedge fund managers, private equity firm partners and real estate investors….

IS THE UNITED STATES COLLECTING ENOUGH TAX?

No. Even before the coronavirus pandemic sparked a deep recession this year, the federal budget deficit here in fiscal 2019 was $984 billion and was forecast in January to top $1 trillion in fiscal 2020, which ends on Wednesday

Policy Basics: Where Do Federal Tax Revenues Come From? Center on Budget and Policy Priorities, Aug 2020

Fair Share….What Is It and Who Determines, by “TheColonel” on Stand Up For America, Oct 2011

What is politicians’ ‘fair share’ of someone’s income?, John Phelan at Center for the American Experiment, May 2021

Taxes and Fair Shares, Chris Edwards at CATO Institute, May 2021

FairShare.org– “Fair Share stands for an America where everyone gets their fair share, does their fair share, and pays their fair share; and where everyone plays by the same rules.”

Biden pushes 17 years of free school, asks companies and wealthy to pay ‘fair share’, Jeff Mason on Reuters, May 2021

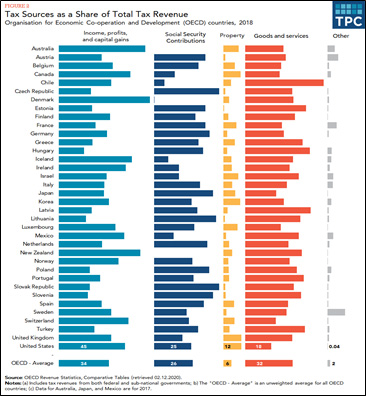

Insights into the Tax Systems of Scandinavian Countries, Elke Asen, Tax Foundation, Feb 2020

Financial position of the United States, Wikipedia