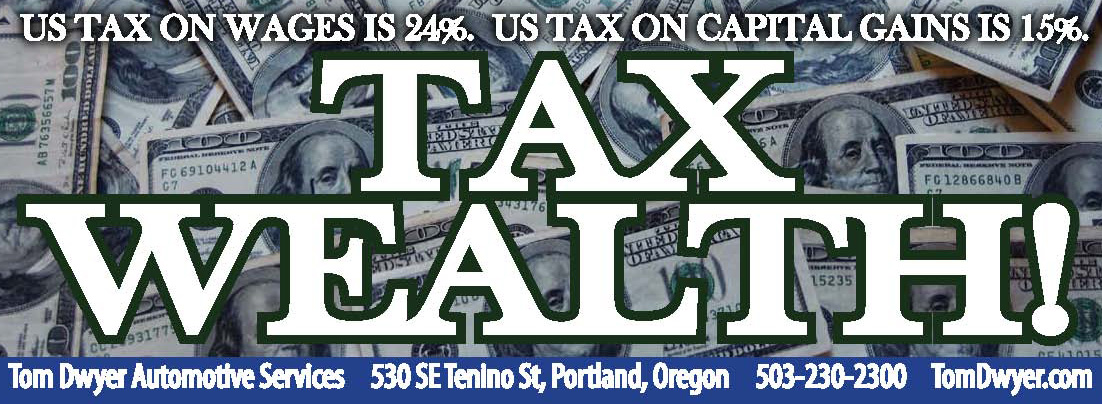

The Devil’s in the details, and this month we found a detail that will make you truly Furious. You may know that Wage (earned) income, the main type of income for most of the Middle Class, is taxed at 24% while Capital Gains (unearned) income, the main type for the Leisure Class, is taxed at 15%. (Didn’t know that? Well then, we’ve probably already made you Furious!) But it gets worse. To use the clickbait phrasing, here’s the “one little trick” that the Wealthy use to avoid even that paltry 15%…

The Devil’s in the details, and this month we found a detail that will make you truly Furious. You may know that Wage (earned) income, the main type of income for most of the Middle Class, is taxed at 24% while Capital Gains (unearned) income, the main type for the Leisure Class, is taxed at 15%. (Didn’t know that? Well then, we’ve probably already made you Furious!) But it gets worse. To use the clickbait phrasing, here’s the “one little trick” that the Wealthy use to avoid even that paltry 15%…

Middle Classers, we people-who-work, pay taxes on earned (wage) income when we earn it but unearned (passive investment) income is different. You can hold an investment as long as you like, but when you sell it you’re taxed on the difference between the initial and sale value.

Share some knowledge with your friends! Or, at least with random strangers stuck behind you in traffic. Check out our new Custom Tom Dwyer Bumper Stickers in our Lobby Library on your next visit. And as always, they’re FREE to clients!

So here’s the trick… suppose you buy $1M in stock in ABCinc. You watch it grow to $10M and chuckle through the years because that $9M gain is NEVER taxed… you haven’t sold! But then you croak. Your $10M investment is passed down to your avaricious little moppets, who leave the ABC stock alone until it’s gained another $1M. Now they sell it for $11M and have to think about taxes. They don’t have to think too hard though, because they won’t be taxed on the $11M… they’re only taxed on $1M, the difference between what the stock was worth when they inherited and when they sold it! The $9M growth YOU experienced is never touched, and your dynastic wealth is transferred unscathed!

If that’s enough to get you on the warpath, then this should push you over the edge… remember that this is just ONE trick the 1% use to protect their wealth. There are thousands of slimy little loopholes like this, all implemented by lobbyists and tracked by accountants the Middle Class can never afford. The most infuriating thing about this and all the other inheritance tricks isn’t that they’re abuses. The most bile-churning fact is that they’re all perfectly, absolutely, say-it-with-a-straight-face legal.

Digging Deeper…

If It Weren’t For The Estate Tax, The Majority Of The Superwealthy’s Money Would Never Be Taxed, by Matt O’Brien in Washington Post, Feb 2019

Inside the Secretive World of Tax-Avoidance Experts, by Brooke Harrington in The Atlantic, Oct 2015

6 Asset Protection Strategies To Shield Your Wealth, by Robert Pagliarini in Forbes, Oct 2013

Earned Income Is Taxed Differently Than Unearned Income, by Dana Anspach on The Balance, Dec 2018

The 3 Types of Income and How They’re Taxed, by Matthew Frankel on The Motley Fool, Sep 2018

Fact Sheet: Taxing Wealthy Americans, by Americans for Tax Fairness

Here’s Where The Super Rich Keep Their Money, by Emmie Martin on CNBC.com, Feb 2018

The Distribution of Major Tax Expenditures in the Individual Income Tax System, Congressional Budget Office, May 2013

Why American Workers Pay Twice as Much in Taxes as Wealthy Investors, by Ben Steverman on Bloomberg News, Sep 2017